carbon tax vs cap and trade pros and cons

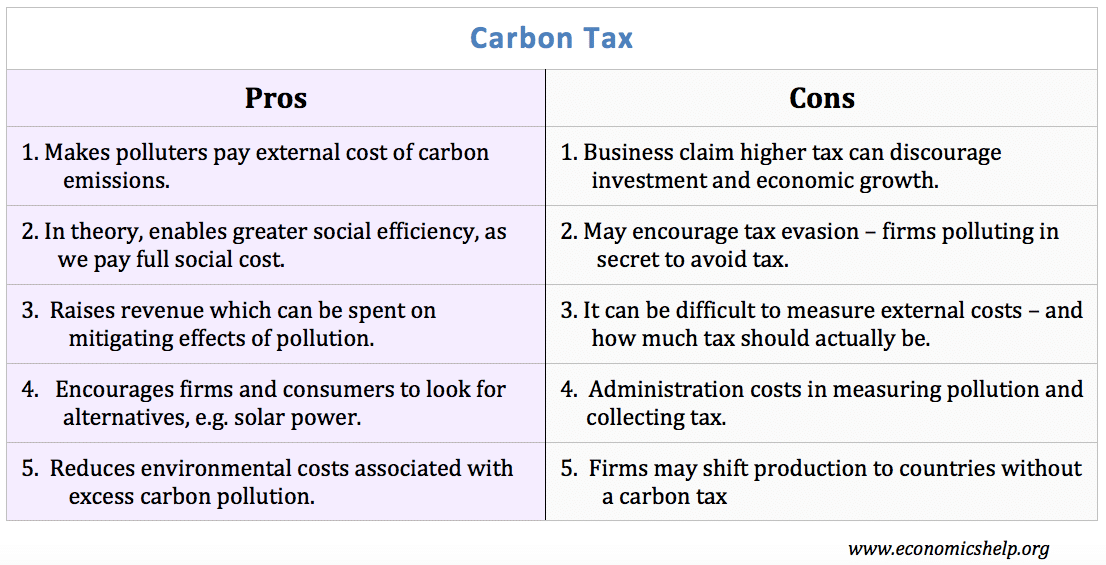

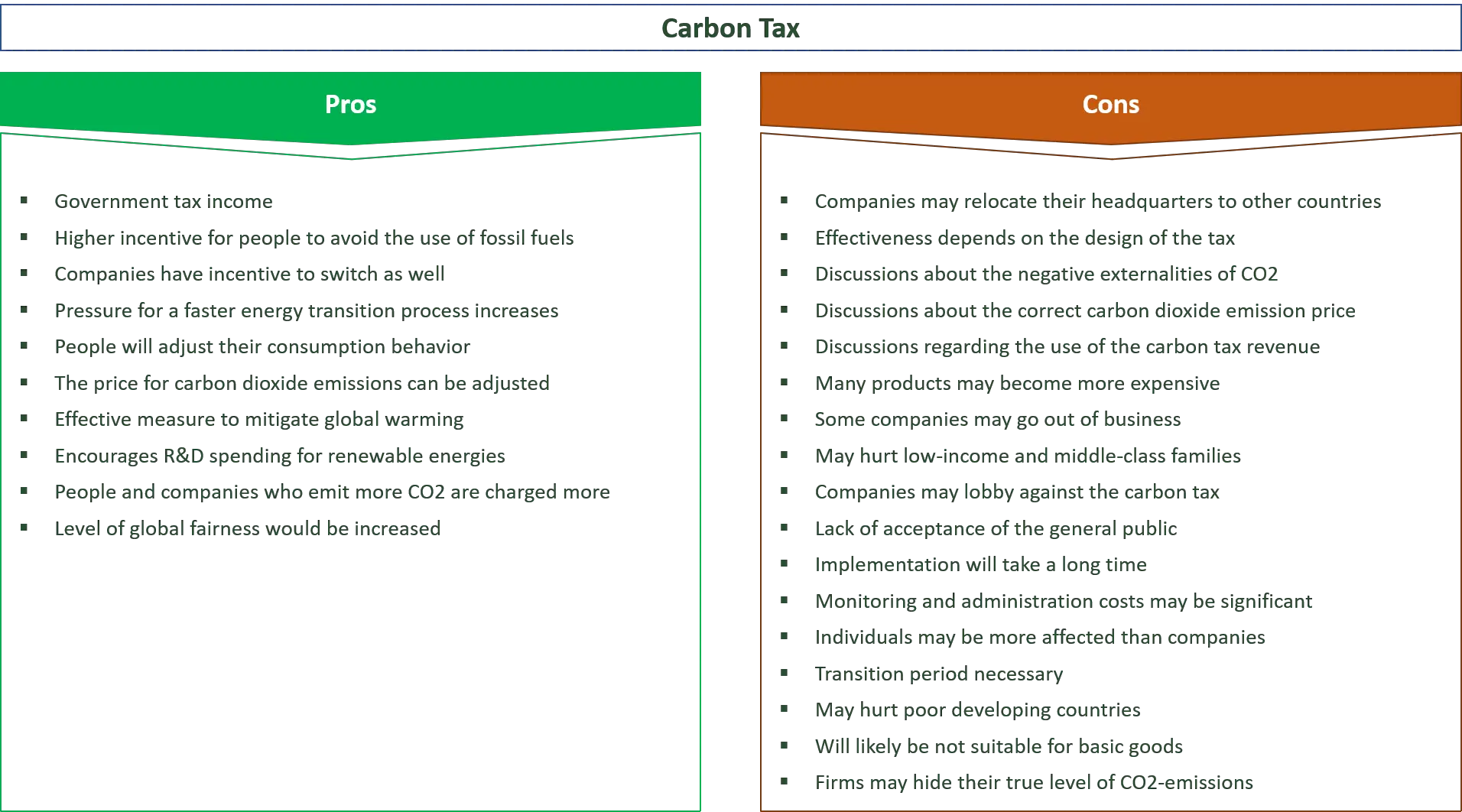

It could start a race for lower emissions technologies which would give energy companies an edge on competitors. A carbon tax could force businesses and citizens to cut back carbon-intensive services and goods.

Carbon Taxes And Cap And Trade State Policy Options Muninet Guide

Simply put the less fossil fuel used the less the tax affects the company.

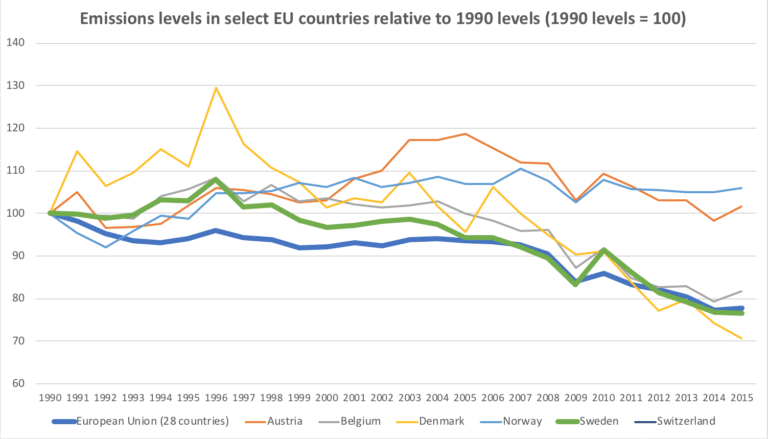

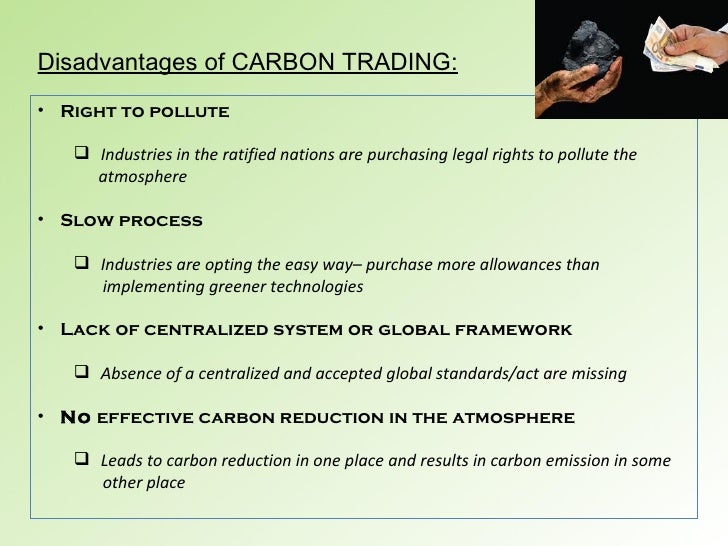

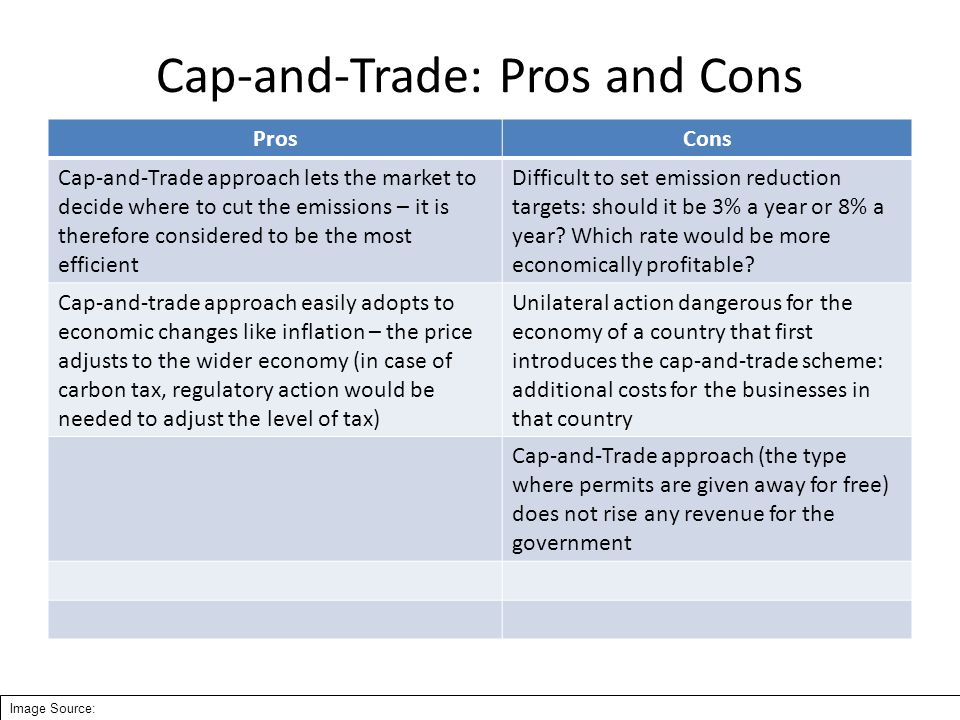

. Together Company A and B emitted 200 units last year and the government wants to halve. Carbon taxes and cap-and-trade schemes are two ways to put a price on carbon pollution each with its own pros and cons Skip to. Cap-and-trade sets the quantity of emissions reductions and lets the.

November 2019 Paper There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential element of any national policy that can achieve meaningful reductions of CO2 emissions costeffectively in the United States and many other countries. A government entity sets a limit cap on the amount of a pollutant such as carbon dioxide or another greenhouse gas. Taken where we have discussed cap trade vs.

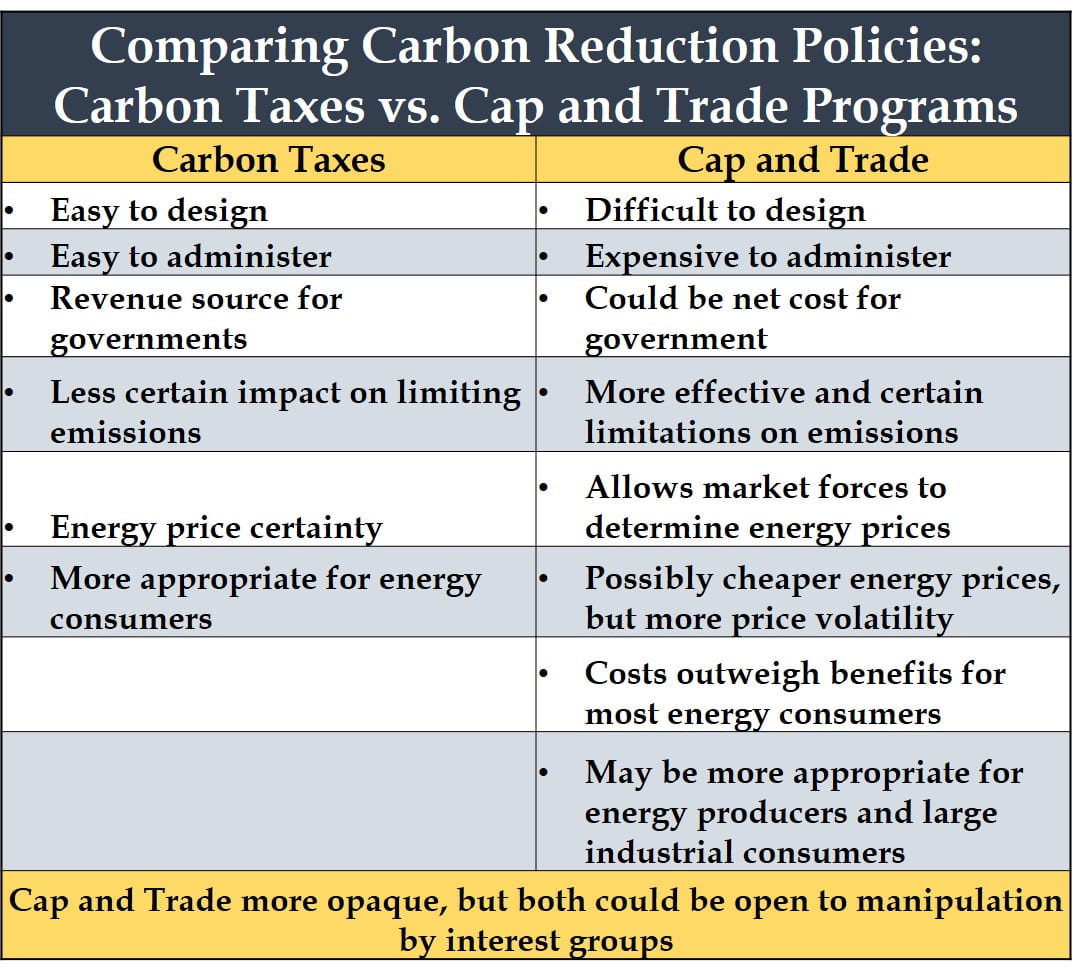

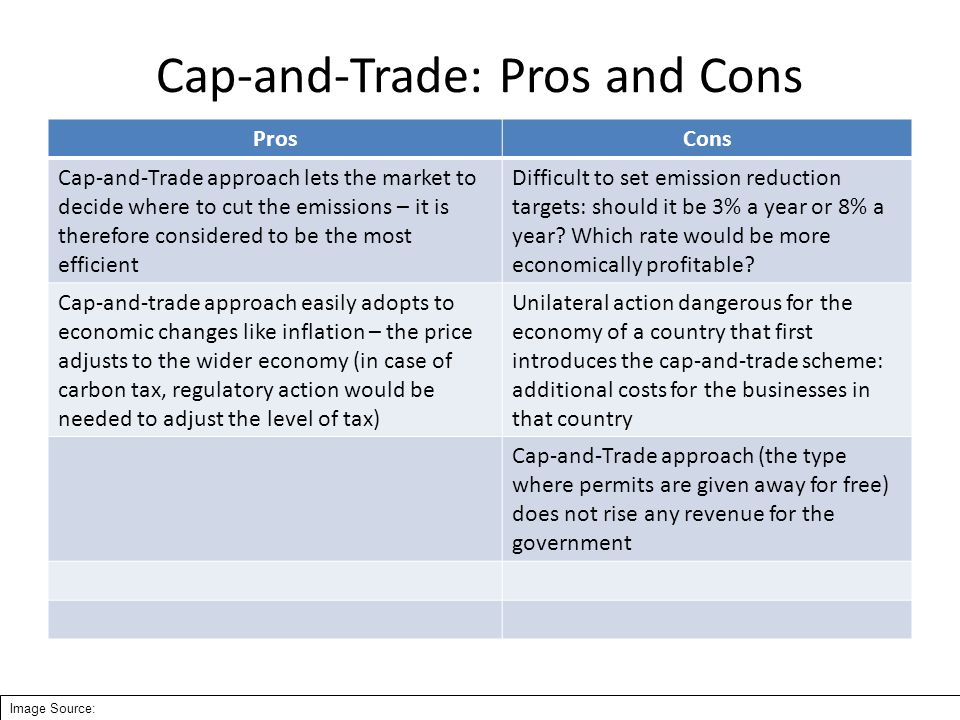

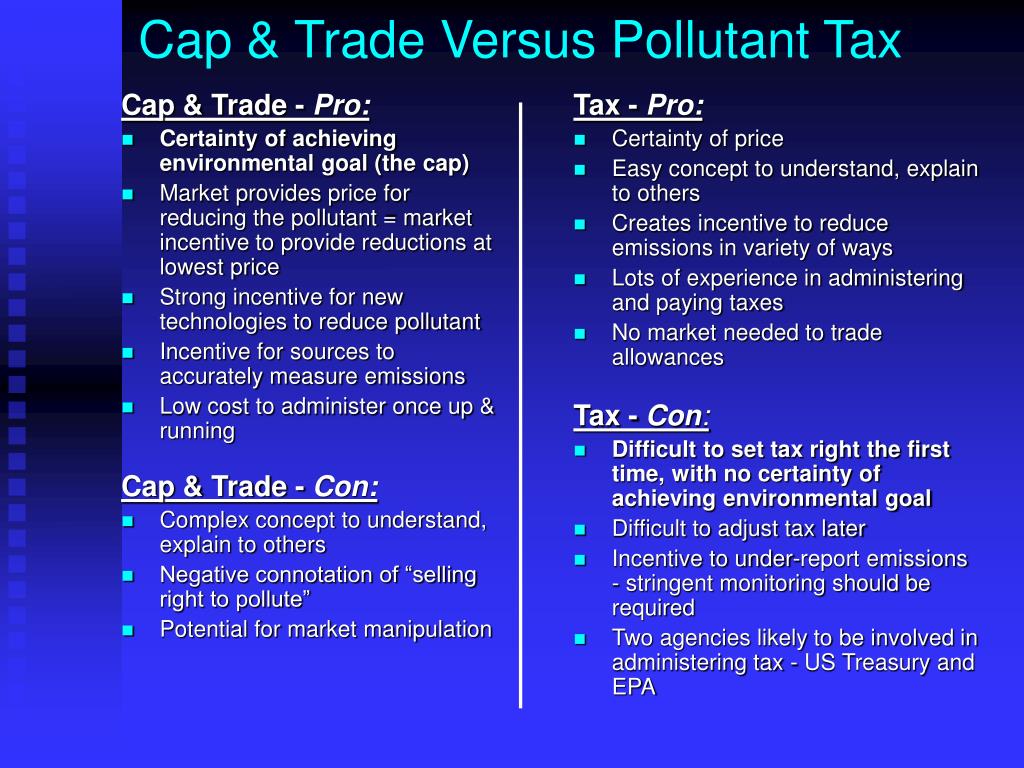

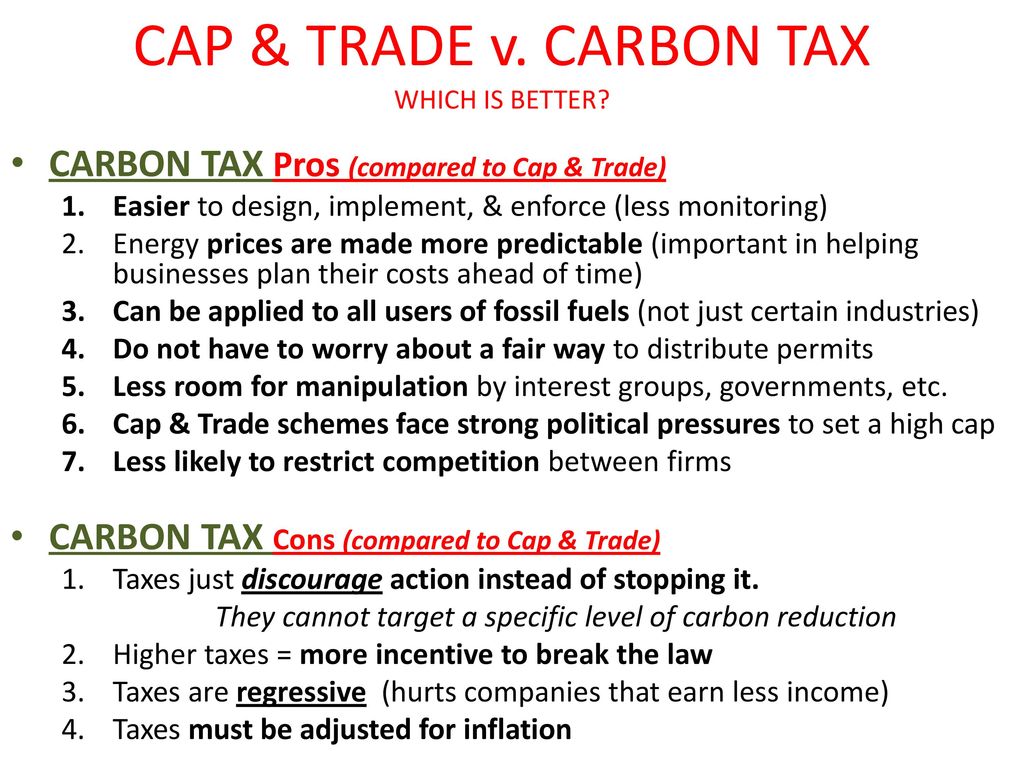

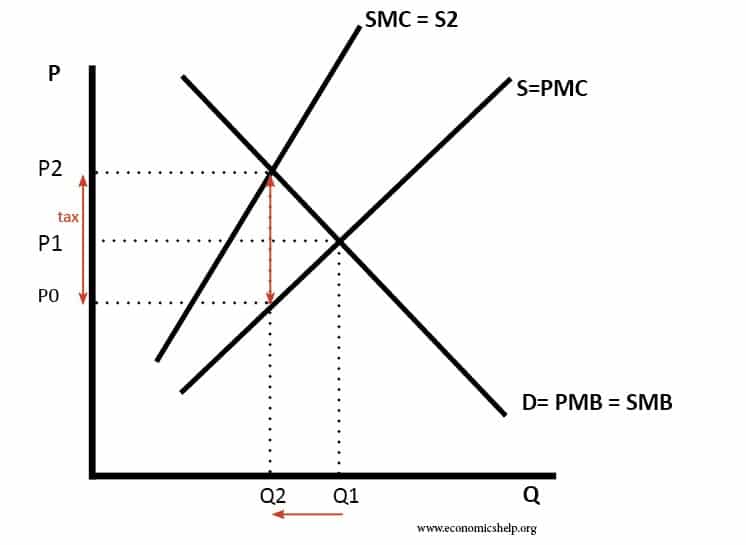

Emissions trading or cap-and-trade CAT and a carbon tax are fundamentally different tools to limit the effects of using fossil fuels. Those supporting a carbon tax argue that it is a better approach because it is. I believe carbon taxes are the better of the two options because it is simple and immediately causes companies and individuals of ways to reduce fuel and energy consumption.

However a cap-and-trade policy offers its own advantages in that emissions allowances can be allocated so as to minimize the policys negative effects on competitiveness and prevent. Each approach has its vocal supporters. With a cap-and-trade system there is a possibility for firms to exaggerate the cost to trade units.

This can be implemented either through a carbon tax known as a. A cost is added to all emissions equal to the level of the tax and this causes people to cut back. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price.

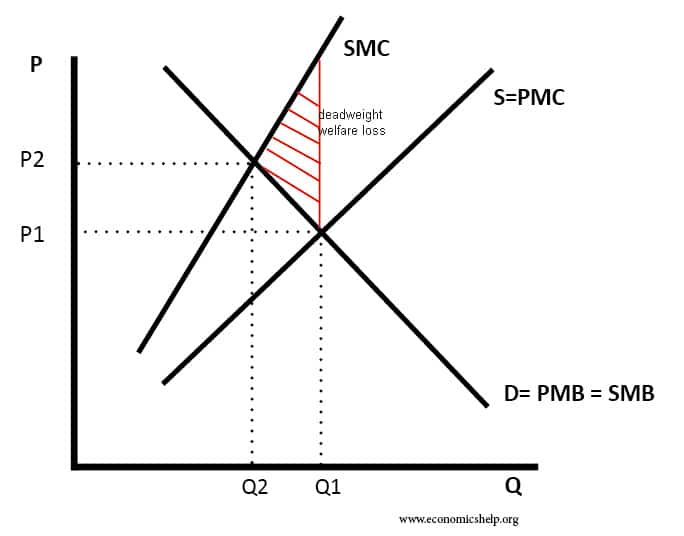

A price on carbon can also be implemented via cap-and-trade programs which limit the total quantity of emissions per year. Cap and trade. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

A carbon tax is sort of the opposite. Yale Environment 360 Editor Roger Cohn asked eight climate policy experts all favoring controls but differing on cap-and-trade versus taxes to spell out their positions. Depending on incentives and economic need both cap-and-trade and carbon tax can be effective ways to price carbon.

This limit is enforced using tradable emissions permits that any emissions. Although no option dominates the others a key finding is that exogenous emissions pricing whether through a carbon tax or through the hybrid option has a number of important attractions over pure cap and trade. If combined hybrid models have the potential to mitigate the disadvantages of both.

I believe both systems have their merits and utilizing either one would positively affect climate change and the economy. Beyond helping prevent price volatility and reducing expected policy errors in the face of uncertainties exogenous pricing helps avoid. There are two primary methods of pricing carbon-carbon taxes and cap-and-trade programs.

Carbon sequestration commonly occurs in agriculture via an increase in. The days of freely dumping greenhouse gases into the atmosphere are coming to an end but how best to price carbon emissions remains in dispute. There is no cap on emissions in a.

Now lets consider a scenario with carbon credits also known as emissions trading or cap and trade. Theory and practice Robert N. When this happens the cost of abatement.

Comparison of Carbon Tax and Cap. The pros and cons of both approaches are neatly summarized in a May 7 posting at the Yale Environment 360 website. Comparison of Carbon Tax and Cap Trade.

Carbon taxes makes emitting carbon dioxide more expensive. Proponents of cap and trade argue that it is a palatable alternative to a carbon tax. Plus some conservatives may be attracted to a carbon tax as an alternative to more EPA regulations.

I believe carbon taxes are the better of the two options because it is simple and immediately causes companies and individuals of ways to reduce fuel and energy consumption. A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial source of revenue. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so.

Congress debates the issue Yale Environment 360 asked eight experts to discuss the merits of a cap-and-trade system versus a carbon tax. Entities that have an overall increase in sequestered carbon may be eligible to sell the extra as carbon credit trade. No matter how much gets emitted a carbon tax makes the emission the same.

A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is politically more attractive. Carbon taxes vs.

Now that weve explored both the option of implementing a carbon tax for emissions or regulating them under a cap and trade scheme lets take a closer look at what the differences are. Several analyses have claimed that a carbon tax is superior to cap and trade in terms of the ability to achieve a fair distribution of the policy burden between polluters firms and consumers to preserve international competitiveness or to avoid problems associated with. Carbon taxes would directly establish a price on carbon in dollars per ton of emissions.

Both measures are attempts to reduce environmental damage without causing undue economic hardship to the industry.

Ppt Cap And Trade Basics Acid Rain Program S So 2 Trading Powerpoint Presentation Id 2711726

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Market Failure Externalities And Beyond Ppt Download

Potential Benefits And Disadvantages Of Linking Regional Cap And Trade Download Table

Carbon Tax Pros And Cons Economics Help

Seneca Esg Pricing Carbon Emissions Trading Schemes Part 1

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Carbon Tax Vs Cap And Trade Which Is Better R Economics

Carbon Tax Pros And Cons Economics Help

Pdf To Link Or Not To Link Benifits And Disadvantages Of Linking Cap And Trade Systems

Carbon Trading Pros And Cons Unbrick Id

Carbon Tax Pros And Cons Economics Help

Economics And Policy At The 49th Parallel Economists Are Like Accountants Except Without The Personality

27 Main Pros Cons Of Carbon Taxes E C

Carbon Tax Pros And Cons Economics Help

World Regional Geography Unit I Introduction To World Regional Geography Lesson 4 Solutions To Global Warming Debate Ppt Download